The Eightfold Path & Mindfulness-via-Taxes

Can Vibe-Coder Adventurism Take Down An Evil Software Empire?

Hello from Udhagamandalam!

I’m up in the mountains of Tamil Nadu completing the third leg of my Train Trip Triangle of India. In 2022, I rode the train (mostly) from Chandigarh to Chennai; in 2023, I rode the train from Delhi to Kolkata; and this year, I am riding the train (mostly) from Kochi to Darjeeling. I’m fond of the weather here in this historic “hill station”, temperate during the day and even chilly at night, and the mountain environment has been conducive to the reflection I tend to do this time of year.

The firework crackbangery, intermittently spaced through the night, marks the celebration of Diwali here, but my mind has been focused on the spookiest of American holidays: the extended US Federal Tax Deadline1. I’ve had to postpone a retreat exploring yoga and ayurveda instead tending to my annual government-mandated “spreadsheet meditation”.

Though my likening tax prep to meditation is partly ironic, I do think there’s something to the notion. I recall, for example, how my otherwise unreligious father would spend most sabbath mornings at his home computer, silently reviewing his personal economics in Quicken. The way we earn our living is critical in Buddha’s Eightfold Path, which features the fifth step of “Sammā Ajīva” or “Right Livelihood”2; indeed, it is the ultimate stage in the trio of steps that mark a life of “Sīla”, often translated as “Virtue”. And so meditating on your money’s comings and goings is more than just complying with IRS requirements, it’s also aligning yourself with the famous Pali Prince’s view of the noble and good life.

While reviewing the past year’s expenses and income is always a moment to reflect, though, this year had an additional complication: my accounting-software-of-choice, Mint, was shut down at the end of 2023. This meant the taxes due last week required a new approach to calculating and compiling aggregate financial statistics. And since this is the age of the Vibe-Coder, perhaps I could craft a quick tool that helps me satisfy legal paperwork obligations while also enhancing the process’s meditative qualities.

A DIY Framework for Holistic Accounting

Having built a couple dozen data apps in the pre-gen-AI days working in a corporate product incubator, volunteering in hackathons and nurturing passion projects, I had a good sense for what I wanted to build, and it didn’t take more than a few hours to have a system that integrated my various accounts and estimated vendors and tax categories. You can even do a lot of automated classification in Google Sheets, though throttling makes this a bit inconvenient for now. I made classification corrections around 10%-20% of the time, which for a personal project was more time-efficient than taking the time to identify air-tight prompting approaches.

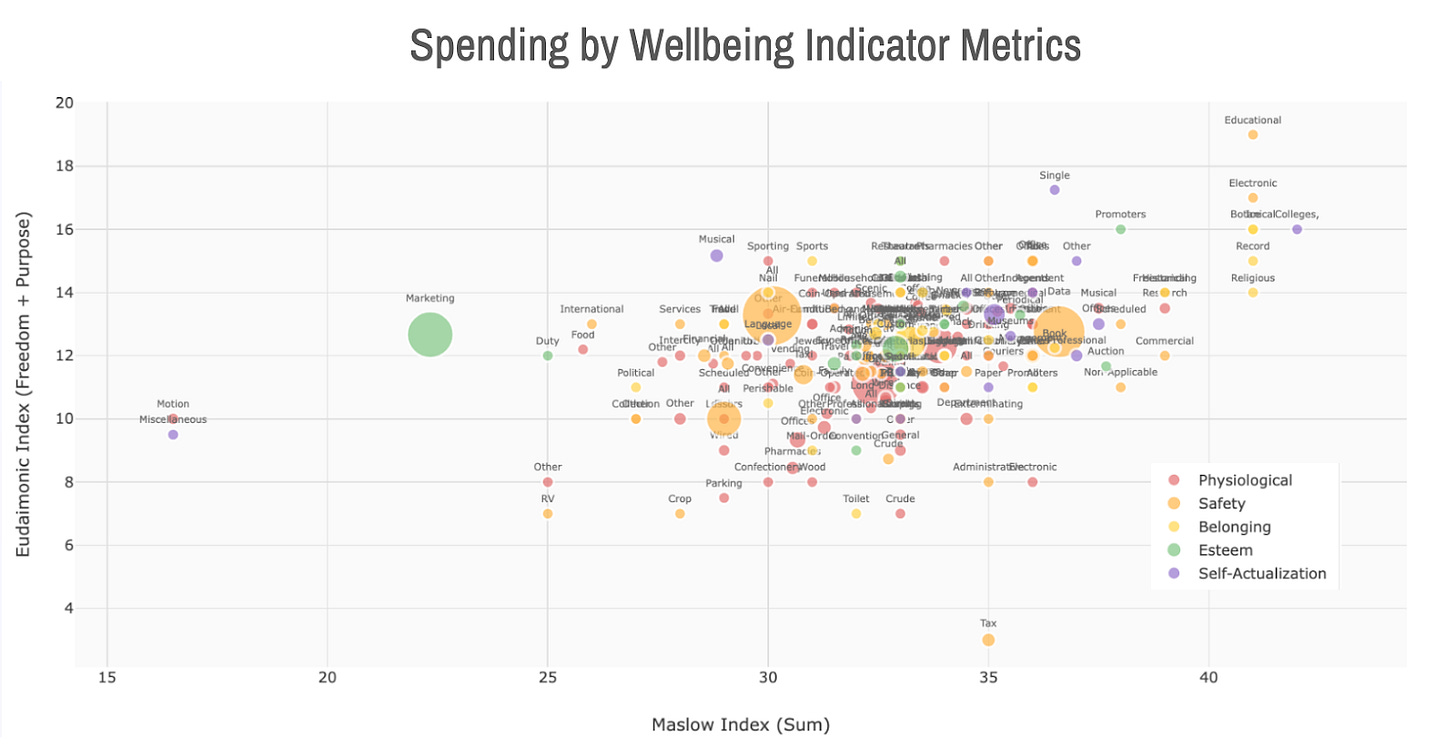

Where things got fun, though, was trying to take the next step and see if I could get advice on my spending from a broader wellbeing perspective. While I’m not a tax expert, I have more expertise in this second broader domain, serving on a couple nonprofit boards that support wellbeing measurement and wellbeing research. For each transaction category, I assessed the transaction on a variety of key measures known to drive wellbeing, compiling them in a Eudaimonic Index and a Maslow Index.

Let’s see a biplot!3

The Eudaimonic Index combines two key factors from Ryff’s Scales of Psychological Wellbeing: Autonomy & Purpose. The full six measures are included in the global wellbeing survey I conduct each month, but I had these two in mind because they were central in a recent interview between Derek Thompson and The Art of Spending Money author Morgan Housel. Summing up his perspective, Housel shares “if there’s one formula in there, it’s a simple formula for a pretty nice life: independence plus purpose”. So I was curious how effectively I was “buying happiness” through this frame.

The Maslow Index scores each item on the five categories in Maslow’s famous hierarchy of needs, assigning a number from 0 to 10. Out of a theoretical 50 points, most categories score somewhere between 25 and 40. I created this because I felt these would be easier for an LLM to map to concrete functional categories, but I’ll need to tune this approach further to improve usefulness.

A few observations:

The top scoring category across both the Eudaimonic Index and Maslow Index was the category containing small monthly contributions to Khan Academy, which I do think contributes to both my wellbeing and to societal wellbeing at-large.

For 2024, the lowest scoring item on freedom was last year’s payments to the IRS. Very “No Kings” inflected.

I am morally wounded by the AI categorizing Uniqlo as a women’s clothing store. What is Sam Altman feeding this thing.

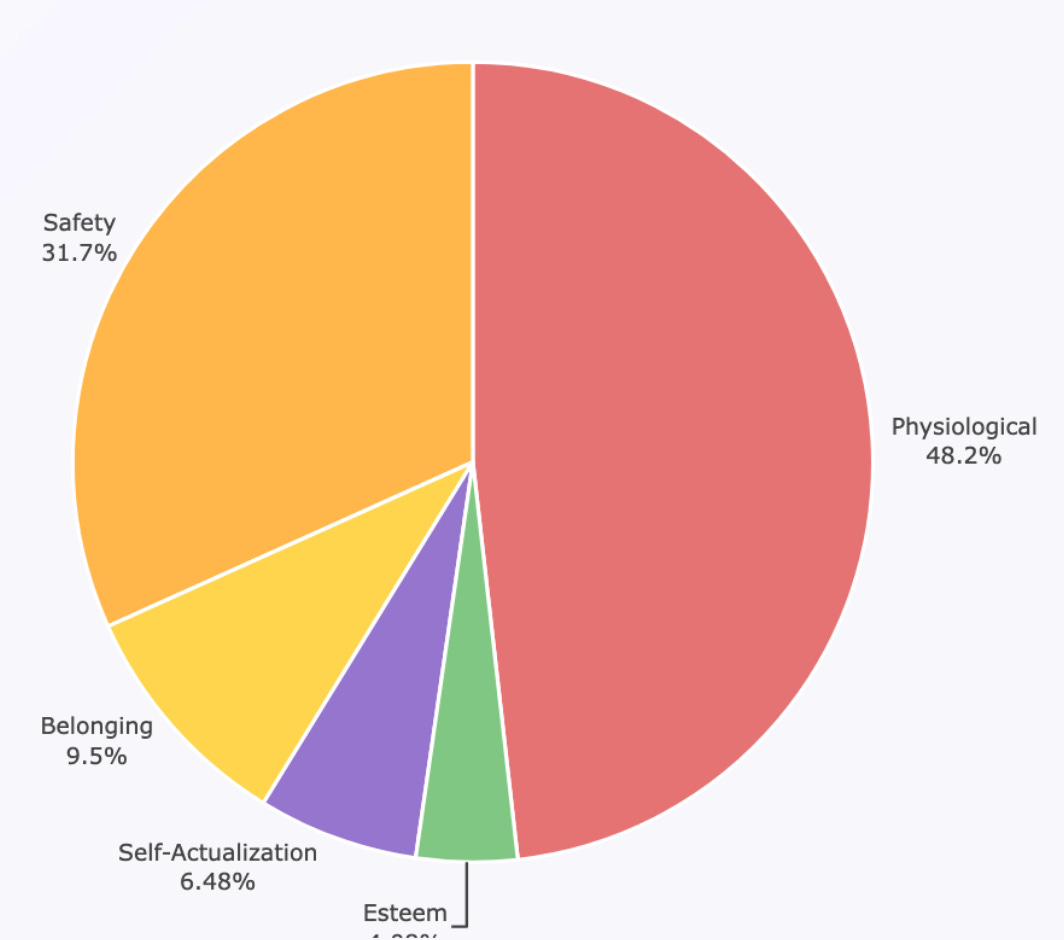

As for how my overall spending breaks down in the Maslowian hierarchy, the portions roughly align with their orientation within the pyramid, though my spending on “esteem” should maybe increase4. Caveats on everything here -- I didn’t proof this analysis as thoroughly as other areas since errors here wouldn’t land me in jail, but I intend to tidy this up a bit before the next tax season rolls around.

The analysis isn’t perfect, but the exercise of reviewing and adjusting these classifications initiates a deeper investigation of how I’m spending money. And I think a simple addition of a feature to let me journal on each expenditure would foster even deeper mindfulness while also providing better context for the LLM estimates.

Call to [Direct] Action

In the wake of the largest protest so far this millennium, protest is on everyone’s mind as a tool of social change; while protest is certainly an important part of the toolkit5, my instincts tend to lead me toward direct action. And of all the kinds of action, the simplest action is often non-action -- that is, to quit supporting organizations that don’t reflect your values. It sounds easy, but it can be quite hard. I’ve spent the past decade trying to quit one of very few organizations in this world that I actively hate: Intuit.

I mentioned earlier that Mint had been shut down sparking this whole project. I didn’t mention that that decision was made by their parent company Intuit, who had acquired Mint in 2009. I have had a long-standing antipathy toward Intuit, their exploitative dark patterns and their regulatory capture of the e-filing process6. I would even tell them as much7 in the feedback surveys after filing my taxes with them. Mint was the only bright spot they had; I’d been a user of Mint since 2011, and it had become a central part of my budgeting process, so when they shut it down, I knew I had to finally draw the line and quit.

I am sure I’m not the only person who feels trapped supporting a software company in opposition to their interests. I would like to see LLMs spark a thousand bespoke personal finance solutions tailored to unique needs at affordable costs. AI can enable non-violent adventurism and entrepreneurship -- so-called “creative destruction” that improves consumer outcomes. We’ve existed inside the mono-web so long, we don’t even think about how weird it is that we share personal financial information with a giant corporation that consistently acts against our interests.

We can live in a world where the people building our software are community members working on projects for people they interact with face-to-face, more like an electrician or barber. These contexts are less alienating for software engineers to work within, and I think they’ll result in products better targeted to diverse users and use cases.

And when we do choose to use a large software platform, we will know we have available alternatives quickly and easily available to us. I still did choose to use a broader digital platform to submit my return; the personal finance app I vibe-coded only focused on calculating the numbers I needed, but I was able to use Cash App Taxes to do the rest. They didn’t charge me at all, and it seems like just a play to increase awareness and usage of Cash App. I’ll stay vigilant as their business model evolves, but at least in this year of 2025, they enabled a smooth and pleasant conclusion for my tax meditation.

I know not every corporate demon can be vanquished like this, and I do try to check my techno-optimism, but since this was a personal success story for me, I wanted to share in case others could take similar action in their lives and finances.

So as a general conclusion, when you hate a company doing evil things, you don’t have to resort to propaganda-of-the-deed to make change. Support a non-violent overthrow in your own budget by building an alternative solution and cutting out the offending organization. It’s never been easier to do so.

And more specifically: don’t use TurboTax. Switch to an alternative like Cash App Taxes. And if/when Cash App Taxes begins its own evil empire phase8, support another consumer coup.

While nothing is certain about the future of AI, I’m hoping that LLM-assisted development allows for more local and neighborly ecosystems of software. But if AI does destroy the world, it does comfort me that either way it will take down Intuit.

October 15th is made less spooky, though, by also being the wedding anniversary of two good friends of mine; happy belated that to them!

I’m tempted to go on a 5000-word tangent about “Right Livelihood”, but I’m trying to make these pieces more digestible. There will be more on this in a later post, and there’s also 2500 years of writing across various cultures and languages if you want to dig in yourself!

Most so-called “self-help” is poorly named in that it is actually trying to help you; only Middling Content provides honest self-help content where you just witness my attempts to help my own self.

I can think GPT-4o is telling me I should spend more on clothes, which is something friends often tell me too.

The spectacle of a large peaceful demonstration draws attention, which can be used for persuasion that in turn can drive outcomes. I think of it as a group of people coming together to create a giant human bar graph measuring their discontent.

The 7.1 billion hours Americans spend in an unnecessarily byzantine tax system is the equivalent of over 10,259 American lives! Intuit essentially funds three 9/11s every tax season! Don’t use them! Use literally anything else!

The “5” in the screenshot seems high, and that’s part because I tend toward friendlier responses in surveys, but it was also strategic. My theory was that the most likely way to get my comment read was if I was a “detractor” that was on the brink of becoming a “passive”, that would be more likely to be analysed in-depth? But that would optimally mean responding as a “6”, which felt too dishonest for me. I can defend a “5”.

Surely it’s unthinkable that Cash App could be sold to a cynically exploitative owner, though; that would never fly with its co-creator: outspoken liberal and befamed beardsman Jack Dorsey.

Hey, great read as always. Love the 'spreadsheet meditation' idea. For me, the realy zen is when all the numbers finally balance out!